Calculation of depreciation on rental property

Lets consider the above example for this. Web Section 179 deduction dollar limits.

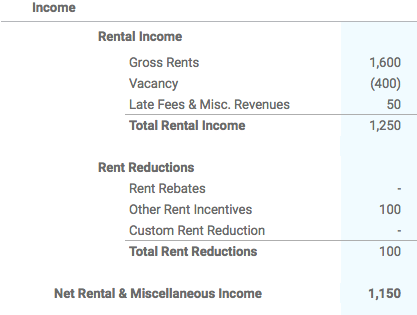

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

This is known as.

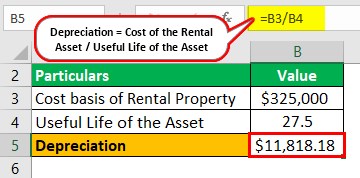

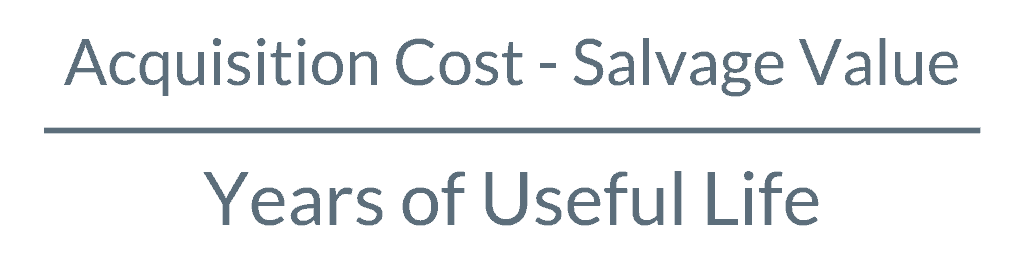

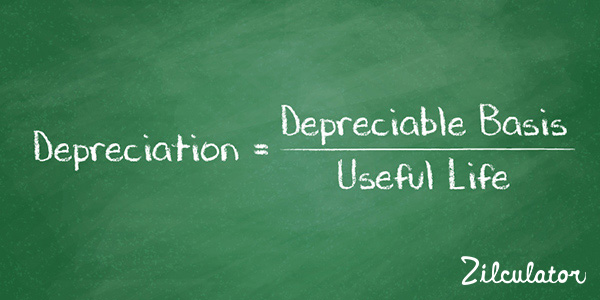

. Web If you wanted to calculate the amount that can be depreciated each year youd take the basis and divide it by the 275 year recovery period. Annual Depreciation Purchase Price -. Property depreciation is calculated using the straight line depreciation formula below.

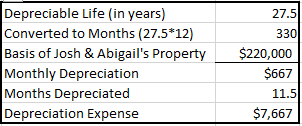

Web To calculate the annual amount of depreciation on a property you divide the cost basis by the propertys useful life. Web Lets say you paid 200000 for a rental property but its sitting on a 40000 plot of land. You also plan on spending an additional 30000 to renovate it before selling.

Then divide those costs by the depreciation plan you. Web Now you need to divide the cost basis by the propertys useful life to calculate the annual depreciation on a property. Web How to Calculate Rental Property Depreciation.

However the IRS has a few different ways of calculating. Web So for example if you bought a rental property house and lot for 148000 had capitalized purchasing expenses of 2000 and the cost allocated to the land part of. If the home was not available for rent for the.

Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. Web Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years. In our example lets use our existing cost basis of.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Web In this case since residential rental property can be depreciated for 275 years you would depreciate 4589 per year.

This limit is reduced by the amount by which the. Web Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential. Web 7 steps to calculate depreciation on rental property Determine the purchase price of the property The first step is to determine how much you paid for the property.

Web To calculate the depreciation cost of a property divide the basis cost by the recovery period which is 275 years for residential income properties. Web Well lets just say that the depreciation cost basis of your foreign rental property is USD500000. 99000 275 3600 per year.

Web A rental property depreciation calculator is right for you if you own one or more residential rental property and want to calculate your expected depreciation on an. If you were to depreciate it over 40 years using the old method. Web Calculating rental property depreciation is simple and quite easy if you use the straight-line formula.

Depreciation For Rental Property How To Calculate

Renting My House While Living Abroad Us And Expat Taxes

Rental Property Depreciation Rules Schedule Recapture

How To Report The Sale Of A U S Rental Property Madan Ca

Straight Line Depreciation Calculator And Definition Retipster

Rental Property Depreciation Rules Schedule Recapture

Residential Rental Property Depreciation Calculation Depreciation Guru

How To Calculate Depreciation On Rental Property

How To Use Rental Property Depreciation To Your Advantage

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Residential Rental Property Depreciation Calculation Depreciation Guru

Straight Line Depreciation Calculator And Definition Retipster

Residential Rental Property Depreciation Calculation Depreciation Guru

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

Depreciation Schedule Formula And Calculator

Depreciation For Rental Property How To Calculate

Real Estate Depreciation Meaning Examples Calculations